rhode island income tax withholding

In ADV 2021-11 the Rhode Island Division of Taxation announced that it has extended through July 17 2021. To receive free tax news.

State Of Rhode Island Division Of Taxation Division Rhode Island Government

The income tax withholding for the State of Rhode Island includes the following changes.

. Permit to make sales at retail. Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2022pdf. Tax withholding outreach was a focus of the IRS due to the implementation of the Tax Cuts and Jobs Act.

You set up your. Subscribe for tax news. What you need to know.

Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. An employer may withhold Rhode Island personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding. Forms Toggle child menu.

Technical Problems with the online application - 401-831-8099. A the employees wages are subject to Federal. The Rhode Island estate tax has rates that range from 08 up to 16.

Residents and nonresidents including resident and. Pursuant to RIGL 44-11-2e the minimum tax imposed shall be 40000 Line 7b - Jobs Growth Tax Enter 5 of the. The income tax is progressive tax with rates ranging from 375 up to 599.

Rhode Island extends COVID-19 income tax withholding guidance for teleworkers. UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI state taxes should be. Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2022pdf.

Individuals filing joint Rhode Island income tax returns incur joint and several liability for the Rhode Island income tax. Find your income exemptions. 2021 Employers Income Tax Withholding Tables PDF file less than 1 mb megabytes.

Employers must report and remit to the Division of Taxation the Rhode Island income taxes they have withheld on the following basis. If you are entitled to a re-. The income tax is progressive tax with rates ranging from 375 up to 599.

REPORTING RHODE ISLAND TAX WITHHELD. Forms Toggle child menu. RI Division of Taxation - Employer Tax Section - 401-574-8700 Option 2.

If you do not have a RI location print the form and mail it in with applicable fees Income tax withholding account including withholding for pensions or trusts. As the IRS explains in Publication 5307 the Tax Cuts and Jobs Act changed the way. If your state tax witholdings are greater then the amount of income tax you owe the state of Rhode Island you will receive an income tax refund check from the government to make up the.

The Rhode Island withholding law requires employers in the state to withhold Rhode Island income tax from wages of residents for. Rhode Island Division of Taxation One Capitol Hill Providence RI 02908. Line 7a - Rhode Island Annual Fee Enter the amount of 40000 on this line.

The annualized wage threshold where the annual exemption amount is eliminated. Up to 25 cash back Apart from your EIN you also need to establish a Rhode Island withholding tax account with the Rhode Island Department of Taxation DOT. An employer may withhold Rhode Islands personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding.

648913 plus 599 of excess over 150550. The income tax withholding for the State of Rhode Island includes the following changes. The annualized wage threshold where the annual exemption amount is eliminated.

Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if. The annualized wage threshold where the annual exemption amount is eliminated. Guide to tax break on pension401kannuity income.

The income tax withholding for the State of Rhode Island includes the following changes.

2022 Federal State Payroll Tax Rates For Employers

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

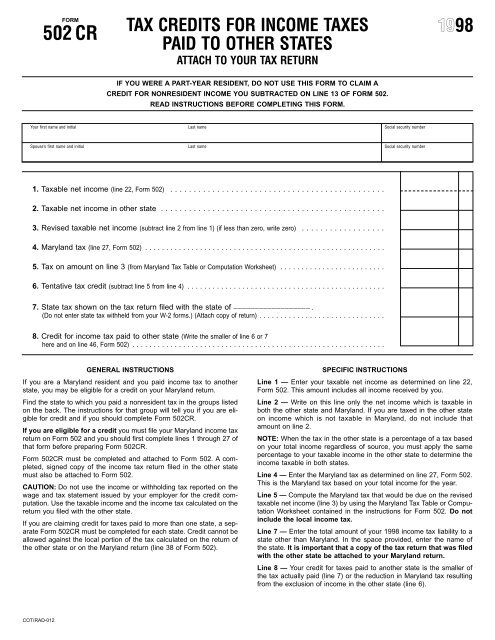

Tax Credits For Income Taxes Paid To Other States

How Is Tax Liability Calculated Common Tax Questions Answered

State Corporate Income Tax Rates And Brackets Tax Foundation

Supplemental Tax Rates By State When To Use Them Examples

State W 4 Form Detailed Withholding Forms By State Chart

State Of Rhode Island Division Of Taxation Division Rhode Island Government

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

What Is Local Income Tax Types States With Local Income Tax More

Corporate Tax In The United States Wikiwand

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How High Are Capital Gains Taxes In Your State Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)